What is an S Corp and should content creators become one?

You may have heard people say that you should become an S Corp or how much you can save in taxes by being and S Corp. In this article we’ll break down what an S Corp is, the potential tax benefits of being an S Corp, and whether or not an S Corp is right for you.

First things first, what is an S Corp?

Short answer

We don’t want to get too deep into the tax code, but at a high level an S Corp is like a special club for businesses where the owners get to save a bunch in taxes while still maintaining the tax benefits of being a passthrough entity. But being in this special club does require you to follow certain rules which we’ll get to in a minute.

Long answer

When you are an LLC, all of the income you make “passes through” directly to you and onto your personal tax return. The LLC does not pay taxes and so you are only taxed once. Only having your income taxed once is a huge tax benefit.

If you were a Corporation (not to be confused with an S Corp which is different), the company does pay taxes on its net income. Then anything left over passes to the owners and they pay taxes again on that amount. So they are taxed twice! But the IRS does give Corporation owners some nice tax benefits to ease that burden.

The S Corp combines the passthrough nature of the LLC with the tax benefits to owners of a Corporation. It is a beautiful mesh of structures that can save you thousands in taxes.

We know you hustled to build your brand and generate revenue. By becoming an S Corp, you are changing your taxes, for the better. You can save on taxes by utilizing business deductions, setting yourself a reasonable salary, and avoiding self-employment taxes. As an S Corp, you will hate tax season a little less.

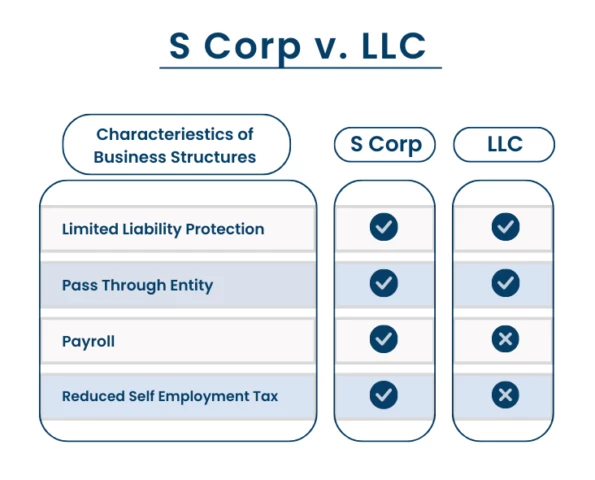

S Corp vs LLC

You may be thinking, can I get an S Corp when I already have an LLC? Of course! You actually need to create an LLC prior to establishing an S Corp. An S Corp is simply an extension of an LLC. They both legitimize the business and offer business liability protection. The main difference between the two business structures are the added tax benefits your business receives as an S Corp.

There’s no minimum income needed to file for an S Corp, but we suggest creating an S Corp when your monthly income is consistently around $8k-$10k per month and is expected to increase. If you are considering becoming an S Corp, we are more than happy to give advice and provide assistance.

Tax benefits of an S Corp

Let’s talk taxes – the less taxation, the better, right? S Corps offer great tax benefits to creators and your business. The main benefit of an S Corp is avoiding those pesky self-employment taxes. You know that 15.3% tax on your earnings that crushes your soul? Here’s how being an S Corp helps you save on those taxes.

Avoiding Self-Employment Taxes

When you are an LLC, all of your net income is considered “ordinary” income on your tax return. That means that you have to pay the full self-employment taxes of 15.3% on your net income.

So let’s say you were just an LLC and had net income of $60,000. You would end up paying $9,180 just in self-employment taxes ($60,000 x 15.3% = $9,180). That really sucks.

But when you are an S Corp, you actually become an employee of the company. When you do this, you will set a reasonable salary and pay yourself (more on that in a bit). This salary is still subject to the self-employment taxes. BUT, the remaining income that is not dedicated to salary is known as a distribution. And this distribution is not subject to self-employment taxes.

Using our example from up above, let’s say you’re an S Corp instead of an LLC. You set your “reasonable salary” at $40,000. On that $40,000 salary, you still pay your full self-employment taxes of 15.3%. This leaves $20,000 left over as a distribution ($60,000 – $40,000 = $20,000). You don’t pay any self-employment taxes on this remaining $20,000 which would save you $3,060 in taxes! ($20,000 x 15.3% = $3,060 in savings).

To be clear, you still need to pay income taxes on the full $60,000, but you get to avoid quite a bit in self-employment taxes.

How to make the S Corp election

After learning all the benefits of establishing an S Corp, you’re probably ready to get started! First, you need an create an LLC if you don’t already have one.

The actual process of creating an S Corp is pretty simple, free, and not time consuming!

Fill our Form 2553

An S Corp is only registered at the Federal (IRS) level. You don’t fill out any state forms. The 2553 Form is what is needed by the IRS to create an S Corp. It is located on the IRS website.

When filling out the form, you need to use your LLC business name your LLC’s EIN, date of formation, and address.

Here is some additional information when filling out the form:

- Effective date: You will want to start your S Corp at the beginning of the current year.

- Tax year: Select “Calendar year”

- Part I – Election Information: Put in all of your information as the only shareholder. Your “Number of shares” will be 100% and the “Date acquired” will be the date you formed the LLC.

- Part II, III, & IV: Do NOT fill out these parts!

If you have any questions, feel free to contact us and we’ll gladly help for free.

Mail the Form

The mailing address will vary depending on your business location. The cover page of the Form will tell you where to mail the Form.

Await confirmation

Once the IRS has reviewed and approved your Form 2553, your S Corp status will be effective at the beginning of the year or the date of your LLC being formed.

Be aware that the IRS can take 4-6 weeks to fully process the information, so don’t fret if you don’t hear right away.

Deadline

The deadline to file the form is March 15th. But don’t worry if you need to file it late (even months late). The IRS understands not everyone will hit that deadline. If you are filing late, just be sure to complete Section I in Part I of the Form.

We’ve never encountered an instance where the IRS rejected an S Corp election when they didn’t hit the deadline.

How to set your Reasonable Salary

Who doesn’t love payday? As an S Corp, you are both the employer and the employee, so essentially you are setting your own salary. You as the employee may think your hard work deserves a higher salary. While your 100% right, you 100% do not want to do that. Here’s why.

Remember those self-employment taxes we discussed? They are applied to your salary, but not the remaining distribution. In other words, the lower your salary, the higher your distribution which means more tax savings.

When establishing a reasonable salary, the goal is to strike a fair balance between minimizing tax liabilities, while not making it abnormally low. If your salary is not reasonable, it will not be approved by the IRS.

Our general rule of thumb is to set up 50% of your net income as salary and the other 50% as distributions. So if you are making $100,000 of net income, you should take $50,000 as salary.

It is important to note that distributions are still accessible and can be taken monthly by simply transferring money to your personal account.

How to Set up Payroll

As an content creator, setting up payroll is likely uncharted territory. Luckily, there are different payment platforms such as Gusto and QuickBooks Online (not affiliates) that can help you get paid! Before that, there are a few steps required:

- You need to set yourself a reasonable salary (see above).

- Choose the frequency of payments. We usually recommend monthly.

- Provide personal tax information.

In addition, most states require tax withholding and/or unemployment insurance numbers for payroll. This varies across states. Registration is free and is accessible on each state website. If you would rather Gusto or QuickBooks to do that for you, you can pay a bit extra (~$200) and they will register with the correct agencies and get those numbers.

Once you complete these steps, you can set up automatic payroll through Gusto or QuickBooks. As an S Corp, you are also able to set up payroll for individuals providing work for the business, family and friends included!

Expect to pay about $40-$50/month to have a Gusto or QuickBooks payroll account.

Don’t have the time to do this? That’s what we are here for!

Additional Tax Requirements

The one downside of having an S Corp is that there are additional tax returns you will need to file at the end of each year.

1120-S

A 1120-S Form is needed to report the income, gains, losses, deductions, credits, etc., of your business. This is very similar to the Schedule C you filed when you were just and LLC. The difference is this is a full return for the company.

But just because you are filing a return, doesn’t mean the company is paying taxes. You can almost think of this as an informational return.

K-1

As part of the 1120-S, you will also be completing a K-1 Form. A K-1 Form reports how much income will be reported on the shareholder’s (your) personal income tax return.

Conclusion

Forming an S Corp is a great way for content creators and influencers to protect their assets and save on taxes. Being an S Corp does complicate your business a bit, but the potential tax savings make it all worth it!

This process may sound a bit confusing, but luckily there’s people like us to help you every step of the way!