How to file taxes as an influencer: Tax filing demystified

If you’re making money as an influencer or content creator, you may be wondering how to file taxes as an influencer. There are two parts to filing your taxes: quarterly estimated tax payments (1040-ES) and your actual tax return at the end of the year (1040). Let’s go through how to file taxes as an influencer and creator:

- Do you need to file a tax return?

- Making quarterly estimated tax payments

- Filing your annual business and personal tax return

The key to filing your taxes is diligently keeping a detailed financial record. That will make everything we talk about below 10x easier and less stressful.

To shamelessly plug our own business, if you’d rather a professional file your taxes for you and keep track of your financials, check out our affordable service.

Do you need to file a tax return?

The short answer is yes. If you made any type of money last year as an influencer or content creator, you will need to file a tax return. We have a whole post about why you will need to pay taxes, so we won’t go too deep here.

One thing we will point out is that if you are a single-member LLC, you do NOT need to file a separate business tax return. Your business taxes will be part of your personal tax return. The only difference is that you will add an additional schedule to your taxes called a Schedule C. The reason is, single member LLCs are considered “pass-through entities”. In other words, the IRS treats your business like an extension of you. It makes your tax filing a whole lot easier.

Quarterly Tax Payments

Unfortunately, filing your taxes is not a once-a-year event. If you are making money throughout the year, you will need to make estimated tax payments to the IRS and your state (a lot of people forget about the state part) every three months.

You need make these estimated payments because you are considered self-employed. But wait, you might say, why didn’t I need make quarterly payments when I worked at a company? The answer is your employer automatically deducted state and federal taxes from every paycheck and paid them on your behalf. So there was no need to make payments on your own.

When you are working on your own, no one is deducting those taxes for you, so you need to do it yourself. Oh the joys of working for yourself!

How much should you pay in estimated taxes each quarter?

This is highly dependent on how much you make, if you are single vs. married, if your spouse makes money, and many other factors.

At a minimum, you will need to pay your FICA taxes (your Social Security and Medicare). Ready for some bad news? The FICA tax is 7.65% for both the employee and the employer, or 15.3% combined (7.65% + 7.65%).

When you worked at a normal job, you (the employee) only paid 7.65% and your employer paid the other 7.65%.

BUT if you are self employed, you are both the employee AND the employer. This means you need to pay both portions, or 15.3% (7.65% x 2). Ouch!

Honestly, we recommend working with a tax professional to help you figure what your estimated quarterly tax payment should be.

If you want to do it yourself, we created this slick free Excel tool to give you a rough estimate of your estimated tax.

Estimated Tax Worksheet (Template)

How do you make estimated tax payments?

Figuring out your taxes can be tricky, but actually paying them is super easy. All you need to do is go to the IRS website, enter a few pieces of information, and you’re set!

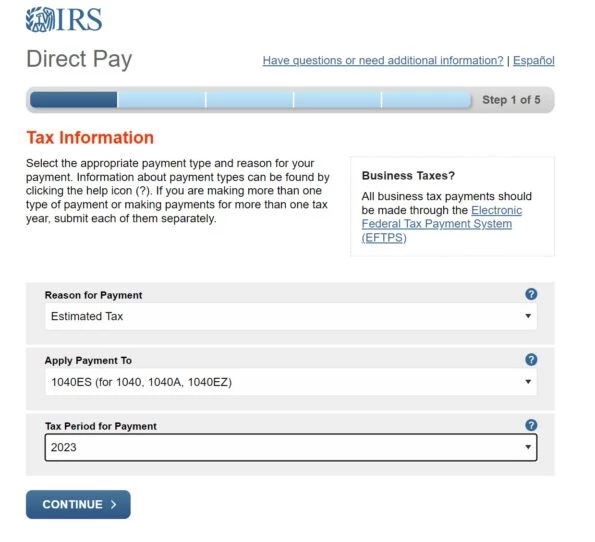

Step 1:

After going to the website, select “Estimated Tax” from the drop down and the current year.

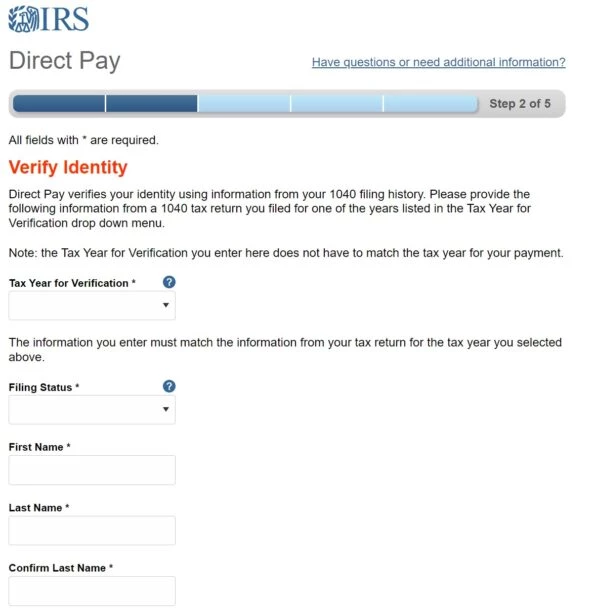

Step 2:

You will need to enter some personal information and information from your last tax return so that the IRS applies the estimated tax to the right person.

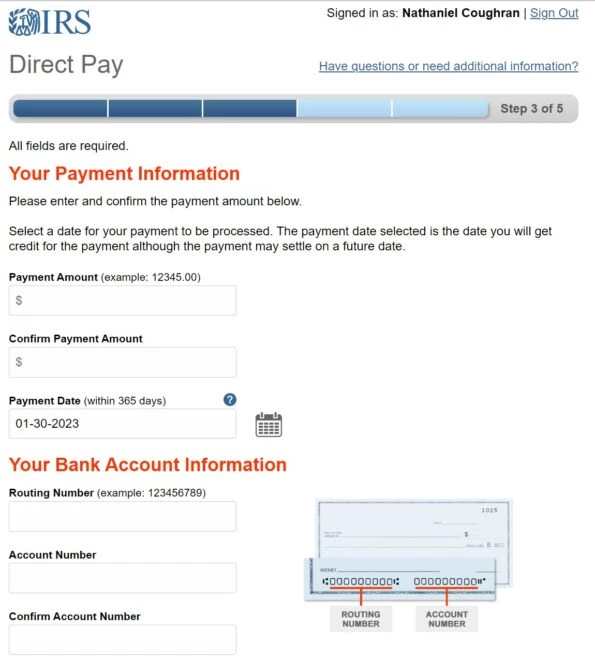

Step 3:

Enter your estimated tax amount as well as your bank information.

And that’s it! Make sure you keep a copy of the confirmation just in case something gets messed up.

Making estimated state tax payments

Every state has their own system to pay your estimated taxes. If you just search “Make estimated payment for [insert your state]” the first link should take you to the government’s site.

You will likely need to create an online account to make the payment.

Just like the IRS, make sure you keep a copy of the payment for your records.

How to file your tax return

Your annual tax return is due around April 15th, although you should aim to get it done well before then to avoid missing the deadline and paying a fine.

If you opt to do your taxes yourself, you should 100% use a software like TurboTax (not an affiliate) that will walk you through each part of your return (both personal and business). It is pretty hard to screw it up. Once you’re done, the software will automatically e-file your federal and state return for you. Tax software is fairly affordable. Look to spend about $150-$200 to file your taxes.

If you’d rather spend your brain cells building your brand, work with us to track your financials, figure out your quarterly taxes, and file your annual tax returns. Our company only works with influencers and content creators and we offer very affordable packages starting at $195/mo. to become your personal CPA.

Conclusion

To file taxes as an influencer can be a scary thing, but not if you keep a good record throughout the year, stay organized and utilize good accounting software.