Money Management Essentials for Content Creators

Now that you are making money as a content creator, the idea of tracking your income and expenses can be scary and overwhelming. But by keeping detailed records, staying organized, and using a good software, it can be pretty easy. In this Money Management Essentials for Content Creators guide, we will walk through the steps to keep track of your financials and do your taxes more easily.

- Getting a separate bank account and credit card

- Setting up your accounting software

- Keeping detailed financial records

- Making quarterly estimated tax payments

- Filing your annual business and personal tax return

By the way, if you’d rather pull out your nose hairs than keep track of your finances, you should hire a professional to take care of that for you (I know, it’s a shameless plug for our own business). Don’t just ignore your financials, hoping the problem will go away…because it won’t!

Not a single company below is a sponsor or affiliate. Any service or company we recommend is based on our own experience personally using them.

Get a separate bank account and credit card

The very first step (and the most important) to track your business finances is to get a separate bank account and credit card (if you want one) for your business.

Up until this point, you’ve likely mingled your personal and business income and expenses. You need to stop doing this right away! Mingling business with personal will make your life 1,459% harder.

Separating business and personal makes it easier to track your financials (since they are all in one place) and ensures you don’t miss write-offs. We’ve worked with many clients who try at the end of the year to remember all of their business expenses by pouring over thousands of transactions from their personal account. I guarantee they miss many expenses which means higher taxes.

We would also strongly recommend setting up an LLC so that way you have a stand-alone business. Having an LLC will make it much easier to get a business bank account and credit card.

We personally recommend Chase for both your bank account and credit card. Another fantastic bank is Capital One. We have personally used both for our business and personal accounts and had great experience with both.

If you want to use an online-only checking account, our clients have had good experience using Bluevine and Relay.

Regardless of which bank you use, make sure you get the cheapest checking account and a credit card that has $0 annual fees. No need to throw money away on stupid fees!

Put all of your business income and expenses in your new account

Now that you have a new business account, start the process of moving all payments from Google, Twitch, Amazon, etc. to the business checking. Also change all business subscriptions (Adobe, Canva, etc.) to this account or your business credit card. It will take you some time to transfer these items, but it will be well worth the time.

Moving forward, be very diligent about running all business expenses through your business checking/credit card accounts.

Also, many clients have this question: I used my personal card for many business expenses already. Are those expenses still deductible? Yes! In the next section, we’ll talk about how to track those.

Track your income & expenses using an accounting software

Now that you have your separate accounts, it’s time to start tracking your income and expenses. You have two options for doing this:

- Use Excel to track these items manually. Later in the post, you can download our free tracking tool.

- Connect your accounts to accounting software. We personally recommend using QuickBooks for your accounting software. We have also used Xero which we found to be cheaper than QuickBooks but not as user-friendly.

Track using Excel or Sheets

The cheapest way to track your financials is using Excel or Google Sheets. We created a free tracker for you to use if you decide to go this route (see below).

Using a manual process like Excel will require you to manually enter each transaction, but that’s also not the worst thing. It forces you to think about every expense and you have full control over how things are organized.

We generally recommend using the DIY method if you are making <$20k/year or if you only have a few expenses each month. Anything more than that and we recommend using accounting software.

Here is a link to get our free income/expense tracker:

Income-Expense-Tracker-Cookie-Finance-Template

Online accounting software

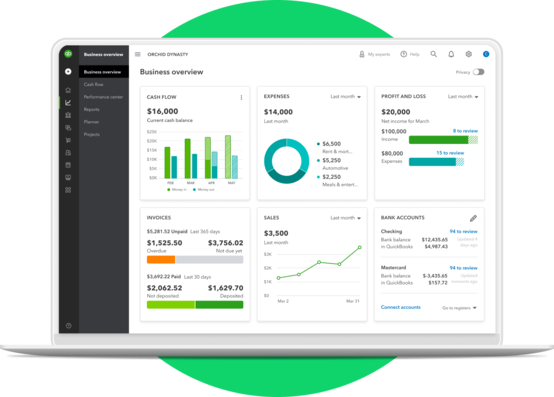

Once you start making decent money, you should upgrade to accounting software to better track your income and expenses. We personally recommend QuickBooks Online (not an affiliate). In fact, we put every client on QuickBooks Online.

Since your business is fairly simple, the cheapest plan available (Simple Start or Self-Employed) will have more than enough features for your needs. This plan is about $30 per month.

After signing up for an accounting software, you will need to connect your bank and credit card accounts so that transactions are automatically pulled in.

QuickBooks makes it pretty easy to keep track of your expenses, send invoices, and see various financial reports like your profit and loss.

Keep detailed financial records

At the end of each month, you should go through and categorize each of your transactions into the correct bucket. QuickBooks will provide you with the most common buckets that you can use for now.

It is important that you do this exercise at the end of each month. If you wait 3, 6, or 12 months to categorize everything, you will be completely overwhelmed (trust me, I’ve made that mistake before!). Plus, by doing this regularly, you will remember what each expense was related to and have an easier time classifying them.

Quarterly Tax Payments

Unfortunately, doing taxes is not a once-a-year event. If you are making money throughout the year, you will need to make estimated tax payments to the IRS and your state every 3 months.

We have a whole separate post on that, so we won’t go too deep here. Just know that every 3 months you will have a tax payment due. Put it on your calendar. Do not miss these payments.

One of the biggest taxes creators are unaware of is the dreaded 15.3% self-employment tax. Because this is such a large amount it is good to pay this regularly to avoid a massive tax bill at the end of the year. This tax is all part of the estimated tax payment you make.

The government likes to be paid regularly. If you wait to pay your taxes until the very end of the year, they can hit you with a penalty.

How to do your tax return

The culmination of your hard accounting and tax work throughout the year is your annual tax return which is due around April 15th. Mark that date on your calendar and aim to get it done well before then to avoid missing the deadline and paying a fine.

Once again, we have a whole post that discusses how to file your annual return so we won’t get into that here. What we will say is that if you have been keeping a good record and paying your quarterly estimated taxes, your tax return should be fairly easy.

By the way, since you are a single-member LLC, you don’t need to file a separate tax return for your business. Your tax return will include a schedule for your business. A software like TurboTax will help you walk through that whole process.

Conclusion

Doing your own accounting and taxes as a creator can be a scary thing but not if you keep a good record throughout the year and stay organized. These are key components of money management that are essential for content creators.

The easiest solution is to hire a tax professional (like us!) who can take care of all of that for you. Our company will make sure you are maximizing your deductions and paying the least amount of taxes possible. This frees you up to focus exclusively on building your brand.