Navigating Tax Brackets for Content Creators

As a content creator, you must learn to navigate a complicated world of financial responsibility, particularly when it comes to paying taxes. In this post, we’ll unravel the mystery behind tax brackets for content creators so that you’re not surprised when Tax Day rolls around.

It’s all too easy to get wrapped up in content creation and engagement and lose sight of the fact that those affiliate links, endorsements, and partnerships may dramatically change your tax bracket and how much you owe in taxes.

What Are Tax Brackets?

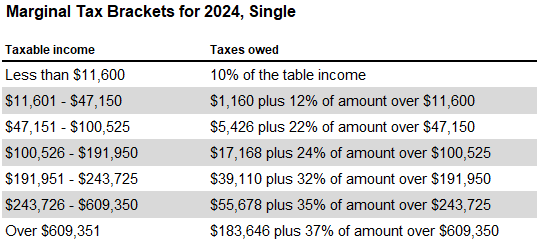

Anyone earning over a certain amount of money per year must pay income taxes on it. However, the US doesn’t have a flat tax. We use a “graduated system” that slowly increases the amount owed as income rises, which means the more you earn, the higher your tax burden. That tax liability is not placed evenly across your entire income, however. We use a series of tax brackets to qualify income and determine what rate applies to specific income levels.

For instance, let’s say you earned $11,600 in 2024. That would put you in the bottom tax bracket with a 10% income tax. However, if you earned $11,601, that would bump you to the next tax bracket and raise your tax percentage to 12%, but only on the dollar more you earned between the two brackets ($11,600 and $11,601).

In other words, you would pay 10% tax on the first $11,600 and 12% tax on the additional $1.

Think of it like baking cookies. The more flour you use, the bigger the cookie pan you will need to have (and the more cookies you’ll need to distribute to prevent them from getting stale on your countertop!).

One Size Doesn’t Fit All: Your Earnings and Your Taxes

There is no one-size-fits-all approach to handling taxes as a creator. One creator might earn $10,000 from their efforts, while another earns $50,000, and another earns $100,000. Each comes with dramatically different tax consequences.

There’s more to it than just the vagaries of what you might earn per year. Because you don’t make a steady paycheck as a creator, you can experience peaks and valleys in your income. You might earn $2,000 in one week but not earn a single penny for another month. That inconsistency makes it critically important that you handle your finances appropriately.

For example, you might earn a substantial amount during the first half of the year but very little in the second half. When Tax Day rolls around, you might be expecting to owe next to nothing or even get a refund from the IRS. Instead, you find that you owe them a substantial amount of money because of your earnings during the first half of the year.

The way around this type of shock is to save money and pay your estimated taxes quarterly. This way, you should avoid having a surprise bill on Tax Day. Another way to help avoid those nasty surprises is to ensure you take advantage of all the deductions available to you.

Sprinkling Sweets: Possible Deductions for Creators

Sound financial planning isn’t just about saving and paying your estimated taxes quarterly. It also involves knowing how to maximize your savings through savvy (but accurate) deductions. What might qualify as a tax deduction for micro-influencers, though?

- A home office and a percentage of your utilities and related costs

- Equipment (camera, sound/video equipment, cell phone, etc.) purchased for use as a creator

- Materials needed for content creation

- Cell phone and cell phone plan

- Internet service

- Marketing and advertising

- Professional services

There are also some deductions that you may be able to take, depending on whether they were truly for business-related purposes. These may include:

- Travel

- Food

- Vehicle

This is just a brief overview of what you may be able to write off. Your specific niche and activities will determine a great deal. For instance, if you’re a travel influencer, then you’ll be much more likely to write off airfare, hotel rooms, restaurant meals, and car rentals than, say, a creator in the interior decorating field. In contrast, they would likely be able to write off more materials and equipment than the travel influencer.

The most important thing to remember when it comes to tax write-offs is that if it isn’t really related to your business, you can’t write it off.

The second most important thing is to keep all your receipts. You must be able to prove what you paid and when you paid it if the IRS questions your deduction. We recommend investing in the right software and working with an experienced financial professional for this.

Staying organized and keeping all your financial information together will be of immense help when it comes time to file your taxes. And, while you cannot claim deductions quarterly, recording what you spent and when can go a long way toward what you can deduct at the end of the year. We recommend that you keep your quarterly tax payment information and corresponding receipts together (whether you’re storing them physically or digitally).

Baking a Strong Support System: Tax Professionals

As a creator, you’re an expert in your particular field. That does not necessarily translate into financial expertise. And even if you do have some financial savvy, managing your growing business as an influencer should command the lion’s share of your time, not dealing with tax planning and financial matters.

Working with the right people is vital. Tax professionals are experts in their field, and they allow you to focus your attention on building your audience and brand. It’s also important to resist the urge to control all aspects of your growing business. Seeking professional advice is a sign of growth and an understanding that you cannot do it all on your own.

Staying Fresh: Adapting to Changes in Tax Laws

US tax laws are not static. They change pretty frequently. Some of those changes involve adjustments to tax brackets. Others affect who can write off what and when. Keeping track of those changes is important because they will affect how you plan and save.

To illustrate our point, here are a few of the tax changes for 2023:

- The standard deduction increased to $13,850 for single filers and $27,700 for married couples filing jointly.

- Income tax brackets increased to account for inflation.

- The maximum Earned Income Credit went up to $7,430.

- The Alternative Minimum Tax exemption amount rose to $81,300.

That’s why you must stay informed and adaptable while utilizing key resources available to you, like Cookie Finance, for the latest information on tax changes and how they affect influencers.

Conclusion

As a creator, you can enjoy a rewarding, lucrative career. You can also build strong relationships with your followers while establishing yourself as an expert and thought leader within the industry. However, you must understand the role tax brackets will play in your financial future and that you’re able to minimize your tax liability over time.

At Cookie Finance, we’re committed to helping influencers just like you achieve financial health while allowing your creative spirit to focus on what you do best: influencing, creating, and interacting with others. We invite you to use our resources and tools to continue educating yourself and learning more about smart financial practices to help set yourself up for success.