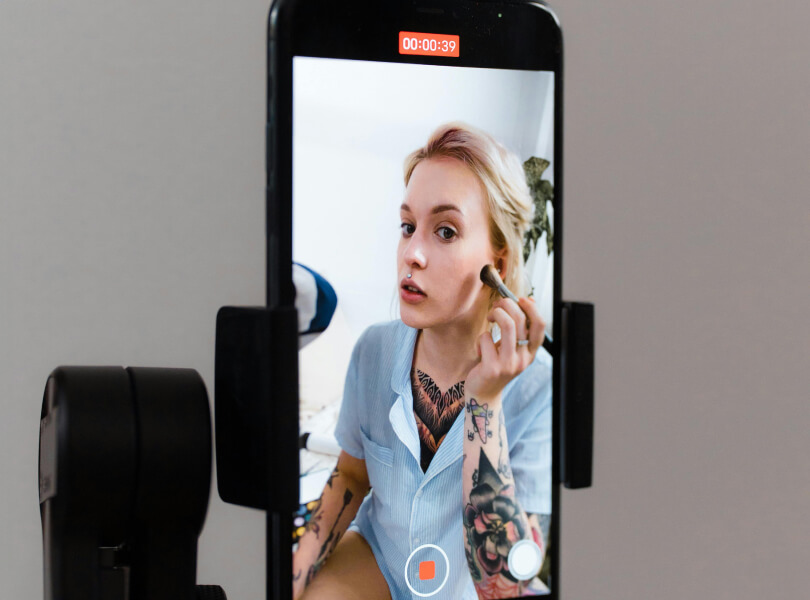

Instagram creator Cameryn saves $17k in taxes

Result: We filed an amended tax return to account for the $53,000 of legitimate clothing deductions, returning $17,000 of taxes to Cameryn.

We worked with Cameryn to identify every dollar she spent on purchases that were related to building her affiliate program. We ended up finding $53,000 worth of expenses that were no-brainer deductions. After amending her federal return, she ended up getting $17,000 back!

On that note, traditional accountants have a really hard time understanding that, for a content creator, their personal life is their business. Because they don’t understand that simple concept, they end up saying that many legitimate purchases are not deductible.

Understanding your cost of goods sold

Every business needs to spend money on the product that they are selling. Whether it is Apple spending money to produce their iPhone or Google spending money on engineers to develop their search algorithm. These costs are called the “cost of goods sold”. These expenses are necessary so that the company can produce a product to sell.

Creators also have a cost of goods sold. They are selling their image, following, engagement, and trust with their audience. For Cameryn, she needs to spend money on clothing (even though she benefits personally from it) in order to promote that clothing on her Instagram. If she didn’t, she would earn $0. These clothing purchases are her cost of goods sold.

Business vs. personal expenses

As a creator, the line between business expenses and personal can be very blurry. The best way to think about what is a legitimate business expense is this: Whatever you spend money on that is building your brand, audience, or engagement is likely going to be a business expense.

Now don’t get too crazy here. Just because you feature your house in a video, doesn’t mean you can write off your entire house.

So even though you might personally benefit from some of these expenses (like with travel), there is still a case to write them off if there is a clear business purpose. You should always be thinking in terms of cost of goods sold 🙂

Working with specialized professionals

Traditional accountants often struggle to fully understand the unique needs and opportunities in your business. Make sure, before working with any accountant, that they have a strong understanding of your industry and are comfortable with the deductions you are rightfully entitled to. Cookie Finance has the expertise to navigate these complexities effectively—schedule a call with us today to see how we can support you!