Between content calendars, sponsored post-due dates, and conferences, content creators juggle many dates and deadlines. While it can be overwhelming, staying on top of important tax dates for content creators is essential to keeping your businesses running smoothly and avoiding headaches later on.

We’re here to simplify your schedule with this friendly guide to the important tax dates for the 2024/2025 tax season.

January 15, 2025 – 4th Quarter Estimated Taxes Due

As a self-employed content creator, you’re responsible for paying estimated taxes quarterly. This date marks the deadline to pay your 4th quarter estimated taxes for income earned between October 1 and December 31, 2024.

Pro Tip: Check your previous payments for the rest of the year. If you’ve overpaid throughout the year, this payment may not be necessary. But if you have underpaid, then you may need to catch up with this payment.

January 31, 2025 – 1099 Forms Sent Out

If you’ve worked with brands, platforms, or agencies that paid you $600 or more during the year, they’re required to send you a 1099-NEC or 1099-K form by this date. If you paid contractors to help create your content, you also need to send them the appropriate 1099 forms. Keep an eye on your mail and email inbox, as you’ll need these forms to file your taxes.

Pro Tip: Didn’t receive a 1099 for every income source? Even if you made just $1 from content creation, you still need to report that income to the IRS.

March 17, 2025 – Filing Deadline for S-Corp and Partnership Tax Returns

If your business files taxes as an S-Corp, you must file your 2024 tax return by March 17. Be prepared to pay any taxes owed as well.

If you are not ready to file by this date, you can file for an extension that will give you until September 15 to complete your taxes.

April 15, 2025 – Tax Day and 1st Quarter Estimated Taxes for 2025 Due

This is the big one! You must file your 2024 federal income tax return and pay any remaining taxes owed.

If you can’t complete your tax return by April 15, you can file for an extension (using Form 4868). However, remember that an extension gives you more time to file, not to pay. Any unpaid taxes will still accrue interest and penalties after April 15.

This is also the date you need to pay your first estimated quarterly tax payment for 2025. This payment is an estimate of taxes owed for income earned between January 1 and March 31, 2025.

Pro Tip: Start gathering your documents early — including 1099 forms, receipts, and bank statements — to avoid the last-minute rush.

June 15, 2025 – 2nd Quarter Estimated Taxes Due

Estimated taxes are due four times a year, and this payment covers income earned between April 1 and May 31, 2025.

Pro Tip: Set aside a portion of your income each month to cover these quarterly payments. If you save 25%–30% of your income each month, these payments will be easy to manage.

September 15, 2025 – Due Date for Extended S-Corp and Partnership Tax Returns and 3rd Quarter Estimated Taxes Due

If you filed for an extension as an S-Corp or Partnership, September 15 is your final due date for your 2024 tax return. All payments are also due.

The deadline for the third quarter covers income earned between June 1 and August 31, 2025.

October 15, 2025 – Due Date for Extended Individual Tax Returns

If you filed for an extension on your individual tax return, October 15 is the deadline to file your 2024 tax return.

Pro Tip: As your content creation business grows, make sure to review your income and adjust your estimated tax payments as needed.

January 15, 2026 – 4th Quarter Estimated Taxes Due

It’s time to wrap up your 2025 estimated tax payments. This deadline is for income earned between October 1 and December 31, 2025.

Conclusion

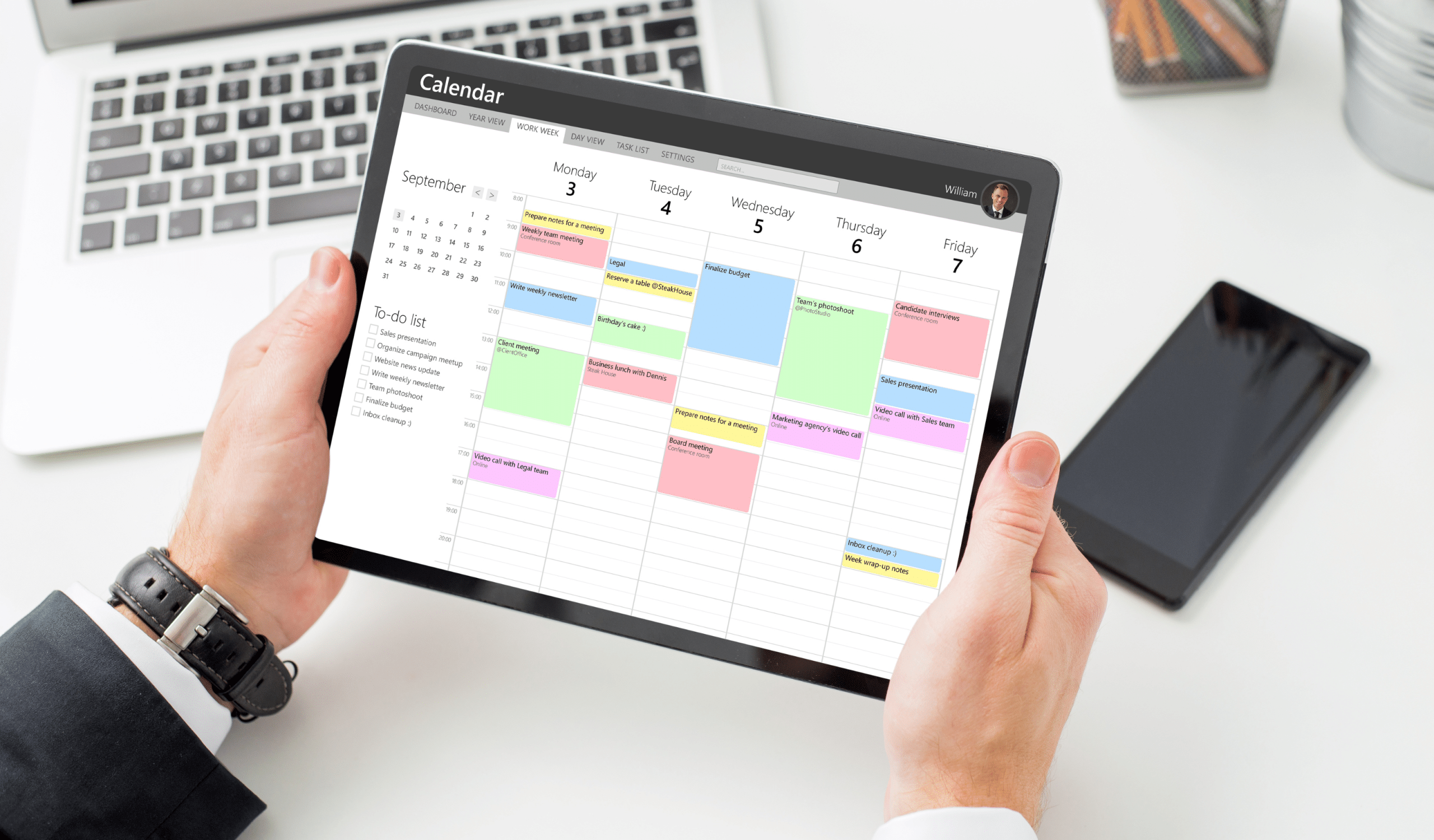

Managing taxes doesn’t have to be overwhelming. You can avoid penalties and keep your business on solid ground by staying aware of these important tax dates for content creators and being proactive with your financial planning. Download our handy calendar to help you remember these dates.

Want help with your taxes and the rest of your content creation finances? Book a call with us to see how we can work together.